New Approach

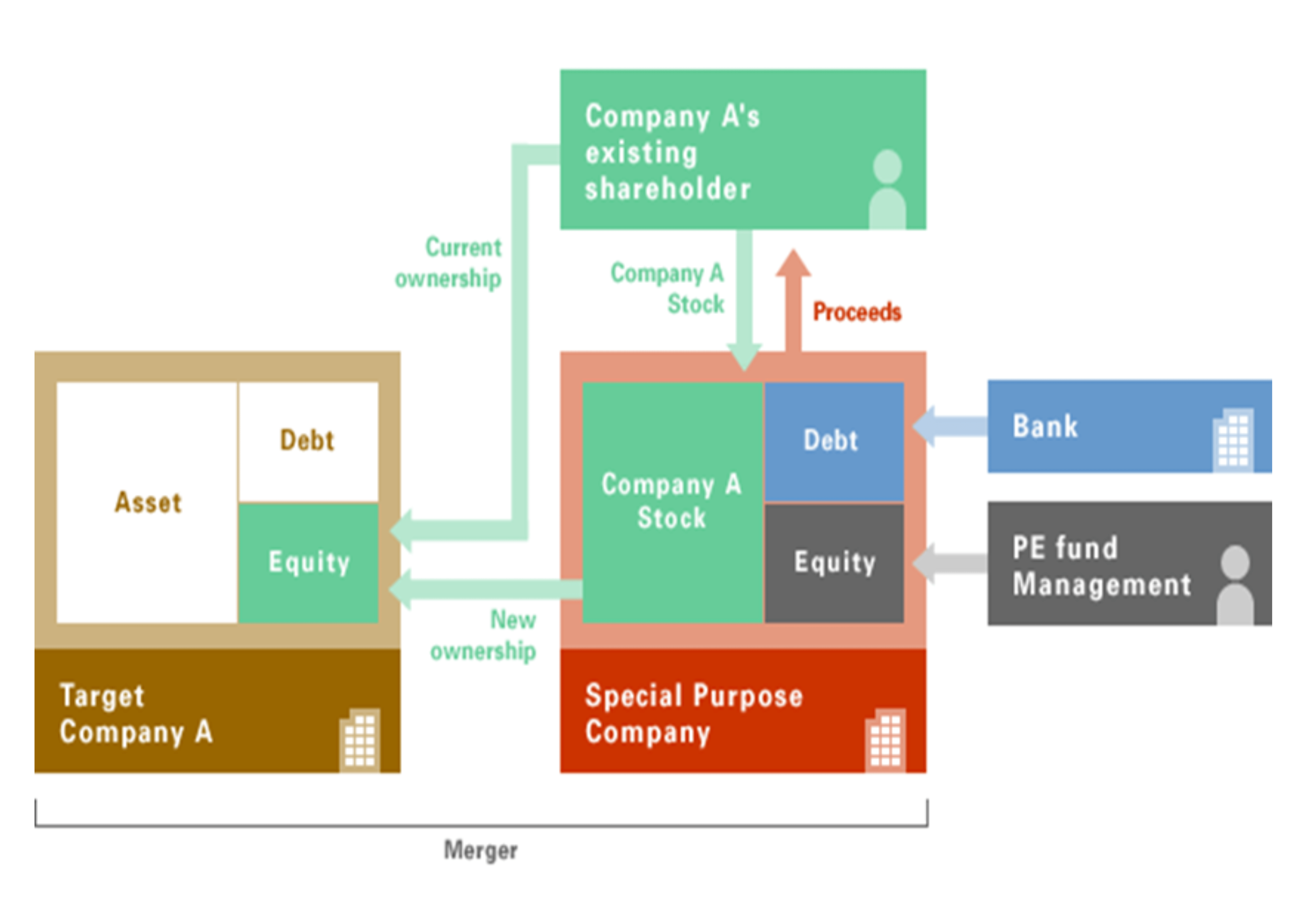

Management Buyout (MBO)

A Management Buyout (MBO) is a transaction where a company’s management team purchases the business from its current owners. This typically involves securing external financing, such as loans or investment, to fund the acquisition. The MBO process ensures that the company’s operations continue smoothly under the new ownership of the existing management team.

How TERAJU Can Assist and Support Bumiputera Companies in Undertaking MBO:

Financing by TERAJU

TERAJU (in collaboration with FIs) can provides comprehensive support to Bumiputera companies through a range of financial and advisory services, facilitated in collaboration with financial institutions. Our support includes:

- ✔ Working Capital Financing: Ensuring sufficient funds for daily operations and growth.

- ✔ Asset Purchase Financing: Funding for acquiring essential business assets, excluding real estate.

- ✔ Mergers & Acquisitions Financing: Financial support for acquiring or merging with other companies.

- ✔ Contract/Project Financing: Funds to support fulfilling contracts and projects, integrating smaller companies into larger supply chains.

TERAJU (in collaboration with SME) can facilitate every stage of the process, including:

- ✔ Identifying and connecting with suitable partners or target companies

- ✔ Advising on optimal collaboration structures, considering taxation, accounting, financing, and commercial factors

- ✔ Assisting in negotiations and liaising with potential partners or target companies

- ✔ Supporting the due diligence process, including analysis and evaluation of potential synergies

- ✔ Managing the collaboration process through to implementation

- ✔ Providing advice on regulatory requirements and compliance

Program

Pusat Maklumat

Alamat

Unit Peneraju Agenda Bumiputera

Tingkat 13, Blok A, Suasana PjH

Jalan Tun Abdul Razak

Presint 2

62100 Putrajaya

Hakcipta © 2024-2026 Unit Peneraju Agenda Bumiputera